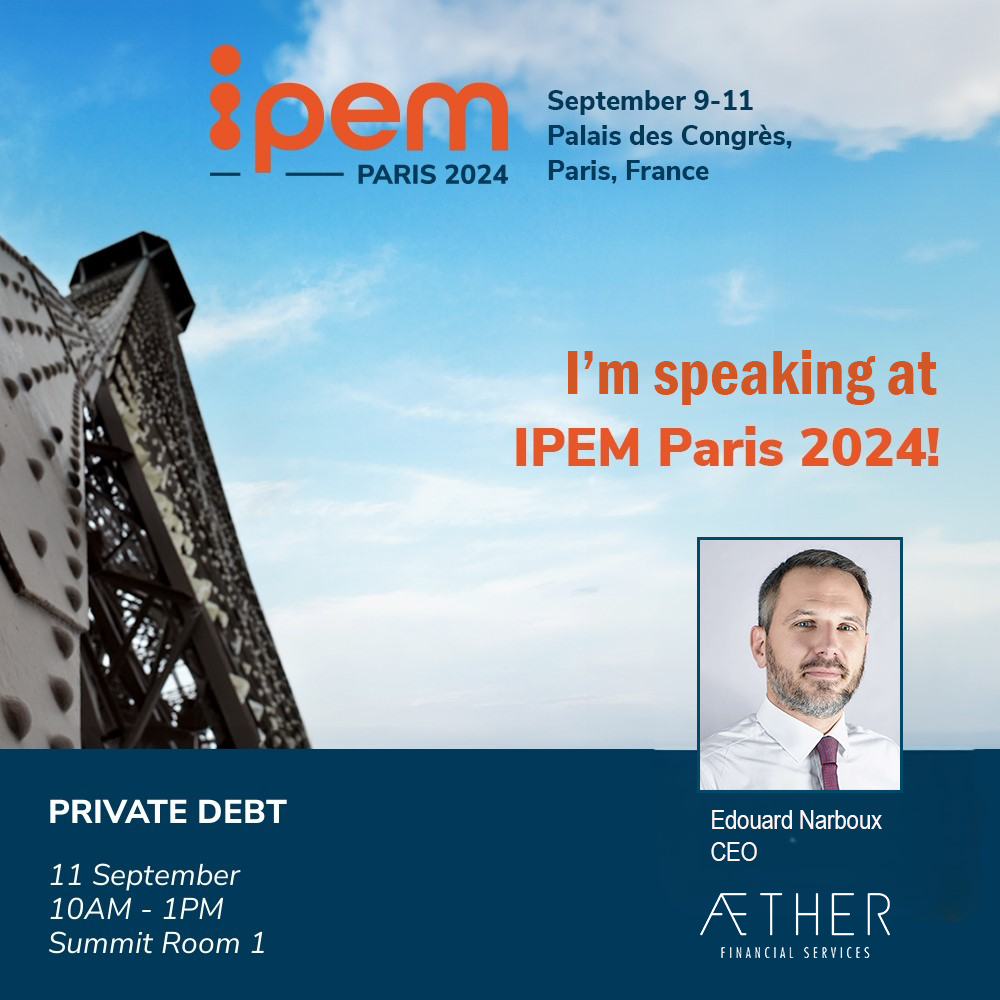

Aether Financial Services partner of IPEM Paris 2024

The World's Private Capital Hub

The must-attend event that brings together Private Equity decision-makers on an international scale.

Under the theme “Forging trust”, IPEM Paris, which took place from September 9 to 11 at the Palais des Congrès, focused on investment confidence. Investing requires trusting your instincts and market conditions, but the past few years have been turbulent for private capital, between fluctuations in interest rates and geopolitical and technological disruptions. While some investors are doubling down on their investments, others are reducing their allocations. Valuing assets and closing deals is trickier than ever for GPs. Major themes such as ESG and climate investing take a back seat in the face of acute challenges.

Among the different topiccs, private debt was not in rest, and had its panel on the third day.

PRIVATE DEBT PANEL SESSIONS

PART 1

- Keep on growing

- More opportunities for private debt to come

- Mapping the private debt asset class risk return profile

- Building a private debt portfolio and allocation plan

PART 2

- Evolutions of the Private Debt Landscape

- Direct Lending in Europe

- Real Assets and Infrastructure Lending

- The Evolution of Special Debt Situations

Edouard NARBOUX, CEO of AETHER FINANCIAL SERVICES had the opportunity to moderate the session "More opportunities for private debt to come" with the participations of:

- Mike CARRUTHERS - Senior Managing Director and European Head of Private Credit for Blackstone Credit and Insurance at BLACKSTONE

- Augustin DUHAMEL - Managing Partner at 17CAPITAL Ken KENCEL - President & CEO at CHURCHILL ASSET MANAGEMENT

- Tara MOORE - Head of European Origination at GOLUB CAPITAL

"In September 21, for the first Paris IPEM, the private debt market was bullish. Sky was the limit. Stars were aligned, COVID behind us… so no cloud in the sky. A year later, in September 22, the hangover was terrible after the bloody summer. September 23 uncertainty was written on everyone’s faces. The last 4 years was like an emotional roller coaster. As of today, where are we? Some will say “the golden age” of the private credit. Others will prefer “a new stage” in the life of this recent asset class in Europe.

But in both cases, how do you see the future? Will private credit continue to perform as strongly as in recent years? Are we reaching the ceiling for the private credit market? Which macroeconomic factors could contribute to the decline/increase of private credit? Are investors as excited for the future of the asset class as they were a few years ago? Is the diversification of the asset class done?"

To learn more about IPEM