Paris, May 20 2025

Publication of the Aether FS Unitranche France index for the 1st quarter 2025

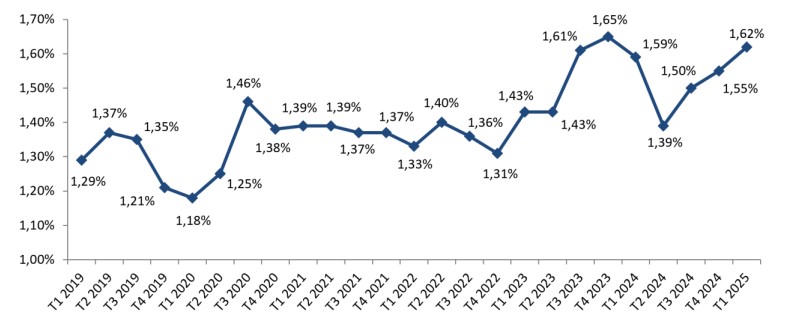

The Aether FS Unitranche France Index continued its upward trend in Q1 2025. The margin per leverage turn stands at 1.62%, compared to 1.55% in the previous quarter. This increase is mainly due to the decrease in leverage at closing.

6 months rolling average interest margin/levarage ratio

As a reminder, the Aether FS Unitranche France Index serves as a benchmark for market conditions in the private debt sector and allows for the evaluation of the cost per leverage turn (excluding base rates) in unitranche transactions in France.

In the first quarter of 2025, the index was calculated based on a total of 36 unitranche transactions carried out in France in Q4 2024 and Q1 2025 (index calculated over a rolling 6-month period), with a total deployed amount of €2.9 billion (slightly down from €3.3 billion in the previous quarter). The transactions remained concentrated in the « Mid Cap » segment, with an average debt amount at closing of €83 million per transaction, compared to €85 million in our previous publication.

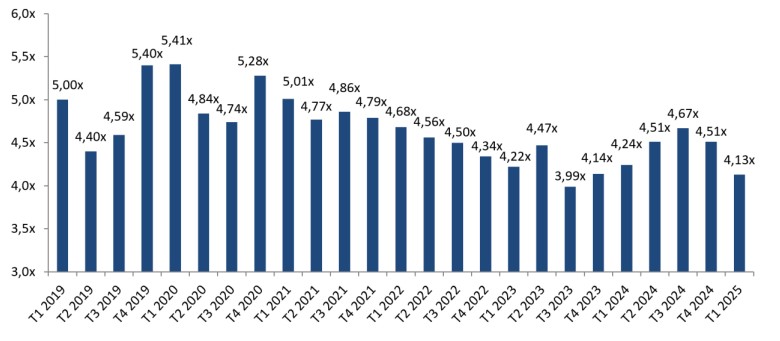

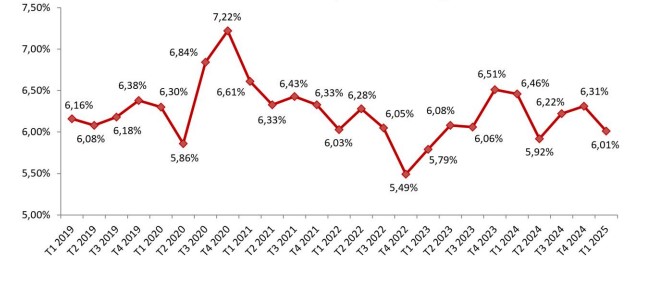

Q1 was marked by a simultaneous decrease in closing spreads and leverage levels compared to the previous quarter. The decline in leverage (4.13x versus 4.51x in the previous quarter) reflects a certain caution towards debt usage in the context of the trade war that affected the early months of the year. Average closing spreads also decreased but remained above 6% (exactly 6.01%), a consistent level in the unitranche debt sector. Since the decrease in spreads was less significant than the decrease in leverage, the Aether FS Unitranche France Index ultimately progressed this quarter.

Evolution of Leverage at closing

Evolution of Spreads at closing

Encouraging Signs for the French Private Equity Market

The French Private Equity market is showing encouraging signs, particularly in terms of fundraising. The sale of 50% of Sanofi’s consumer healthcare unit, Opella, for approximately €10 billion illustrates this trend. The transaction was finalized on April 30. Additionally, funds currently hold record amounts of undeployed capital (« dry powder ») and remain very active in identifying investment opportunities, always emphasizing ESG considerations.

However, the trade war waged by the U.S. administration caused a shock to financial markets in March-April. In this climate of distrust, the private market reacted cautiously towards new operations under negotiation and structuring. A recent PwC study also highlighted a polarization between high-quality assets, justifying high valuations, and those requiring operational transformations to improve their attractiveness. Refinancing or disposals will need to be carried out in the coming months with assets that have not sufficiently deleveraged to present an attractive profile to the market. In this context, participants prefer to opt for an extension of debt maturities.