Publication of the Aether FS Unitranche France Index for the first quarter of 2024

Paris, May 30, 2024

Publication of the Aether FS Unitranche France Index for Q1 2024

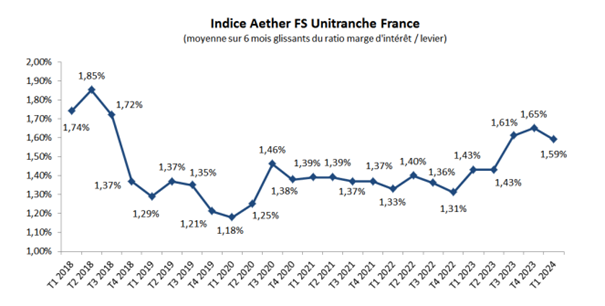

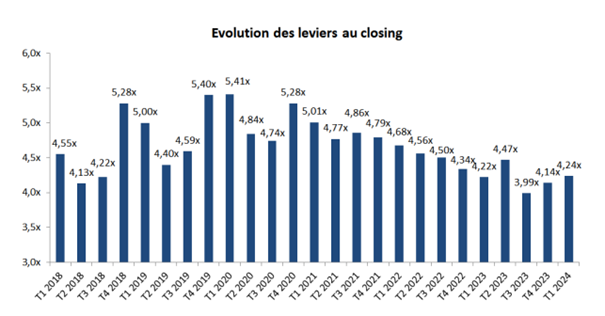

The first quarter of 2024 has sent mixed signals in the realm of unitranche financing operations in France. Despite a further increase in leverage at closing to 4.24x (up from 4.14x in the previous quarter), the margins at closing experienced a slight decline, settling at 6.46% (down from 6.51% in Q4 2023). The Aether FS Unitranche France Index, which reflects the cost per leverage round (excluding base rates), has thus decreased to 1.59%, compared to 1.65% previously. These factors confirm the stability of the unitranche market.

The prospect of a decrease in ECB rates over the coming quarters explains the return of the upward trend in leverage levels. At 4.2x in Q1 2024, these levels remain relatively low compared to the 5.4x reached in 2019-2020. Closing spreads remain relatively high in a context of significant base rates. It is noteworthy that despite its recent decline, the Aether FS Unitranche France Index has maintained an upward trend for over a year, rising from 1.31% in Q4 2022 to 1.59% in Q1 2024 (+21%).

More broadly, the first quarter of 2024 continues the trends observed at the end of 2023. Debt funds are confirming their return to LBO financing alongside banks, which continue to support the "small caps" LBO segment. The number of LBO transactions is on the rise, although the M&A market is still slow to recover (an 8% decline in value for the mid-market according to the Argos index).