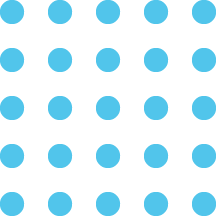

In the second quarter of 2023, the Aether FS Unitranche France Index, published by Aether Financial Services (Aether FS), remained stable compared to the first quarter, with a margin per leveraged round of 1.43%. The number of M&A transactions in France, however, continued to decline in Q2. Furthermore, issuers are increasingly exercising their « Toggle » clause.

The Aether FS Unitranche France Index is a benchmark for market conditions in the Private Equity sector and allows the cost per leveraged round (excluding base rate) to be evaluated in unitranche operations in France.

Despite the stability of this index in the last quarter, the unitranche debt market continued to decline, with only 15 transactions observed in Q2 2023 compared to 36 in Q2 2022. Over the first half of the year, the M&A market in France contracted by 29% according to Refinitiv (data)

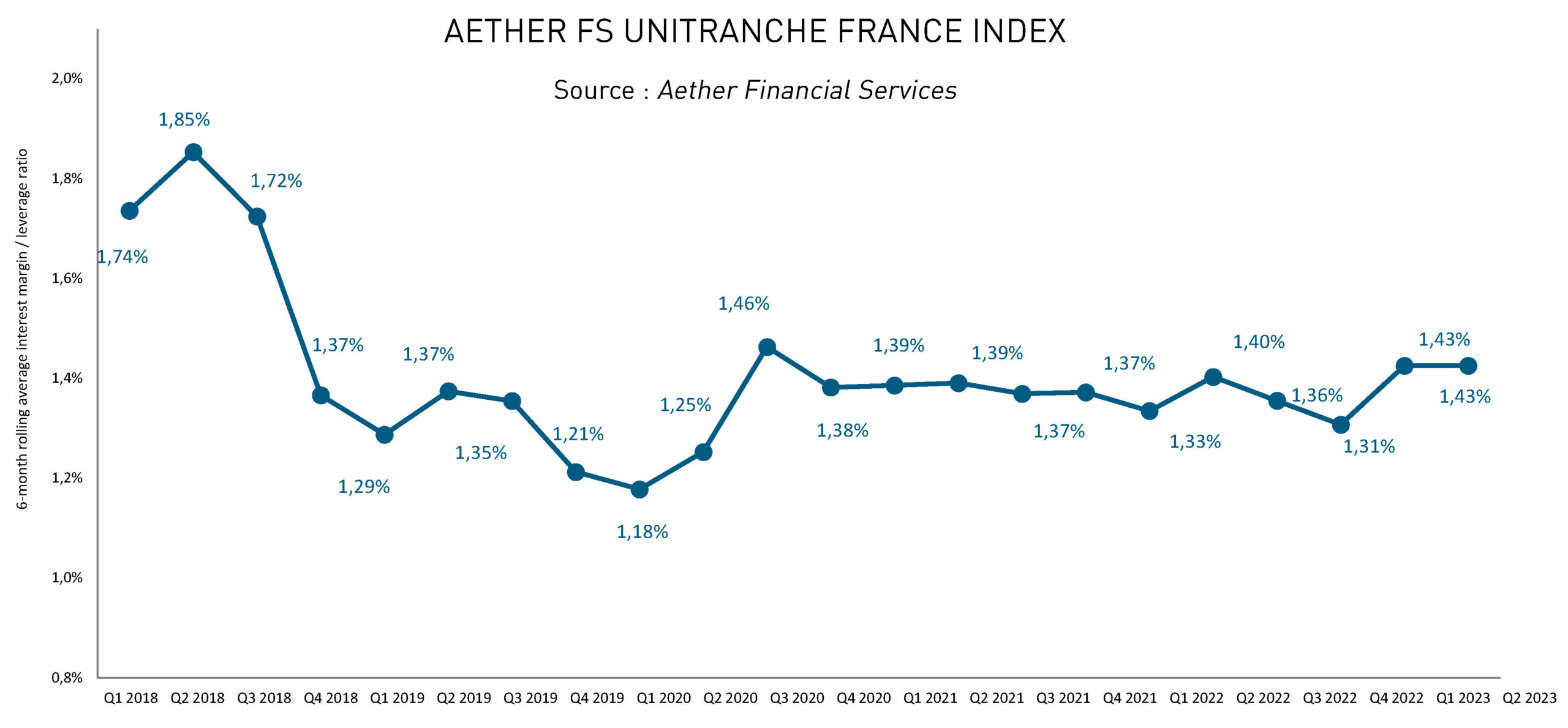

he sharp increase in base rates over the past year and a half has forced arrangers to structure operations with reasonable levers to control future debt service. The payment of financial interest can indeed significantly impact the income statement of borrowers now. Therefore, closing levers are generally more cautious than in 2022, even though a slight rebound was observed in Q2 2023 (4.47x in Q2 2023) compared to the two previous quarters (4.22x in Q1 2023 and 4.34x in Q4 2022).

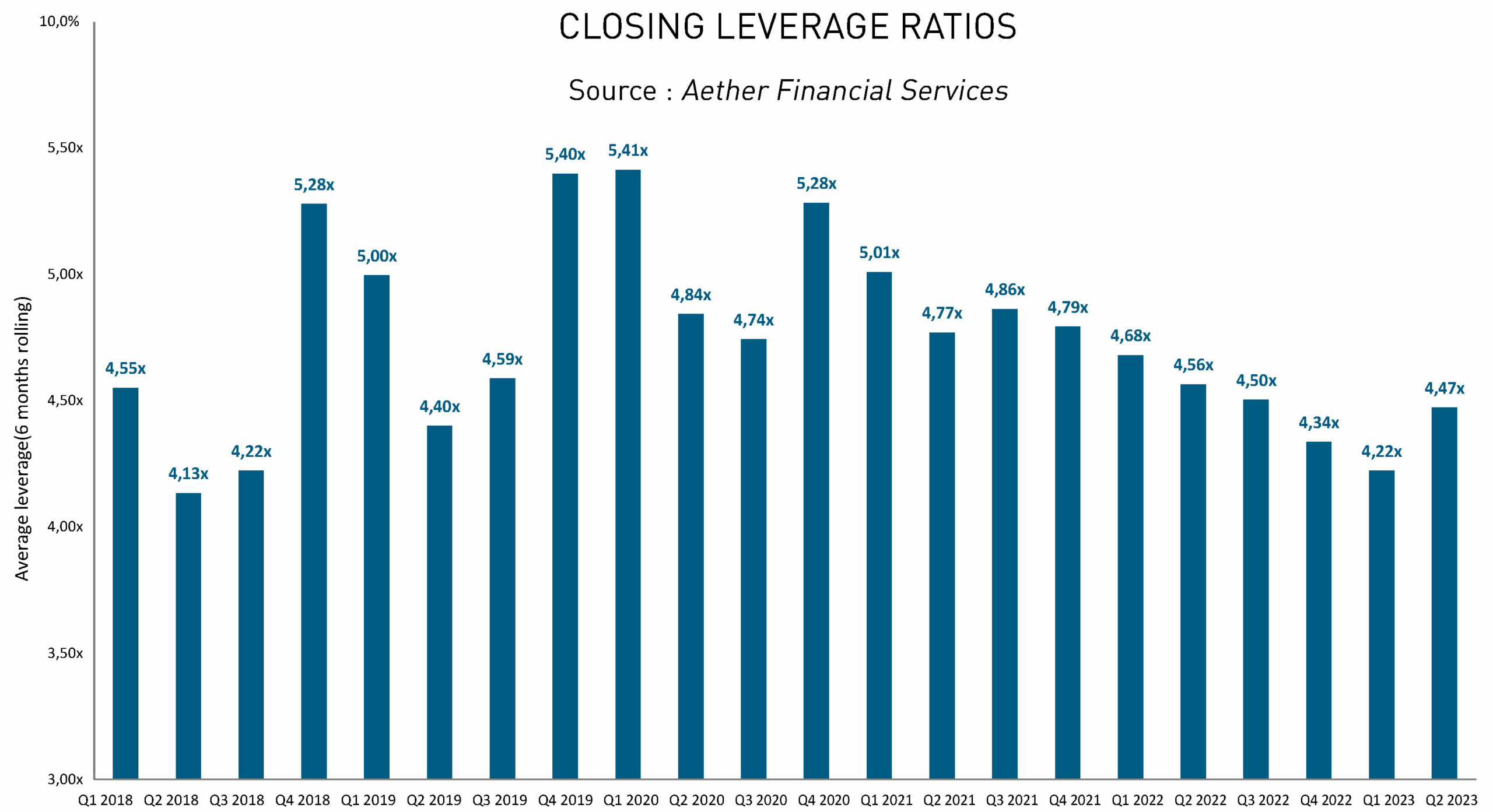

The average closing margins (excluding reference rates) have also increased compared to the previous quarter, coming out at 6.08% in Q2 2023.

How to recover leverage using the toggle?

The Toggle clause is the ability for an issuer not to pay all or part of its cash interest at the end of the period under consideration. These unpaid interests are then capitalized (added to the principal). The first appearances of these clauses date back to 2015, but their generalization in unitranche documentation took place during the Covid crisis.

These mechanisms, rarely used until 2022, have been widely acclaimed since June 2022. Indeed, in a context of rising base rates, issuers must face extremely attentive management of their available cash. In the first half of 2023, 9% of the unitranche portfolio for which Aether FS intervened thus exercised its clause in order not to pay its cash interests.

This option given to issuers is very useful in a context of short-term uncertainty. Issuers must not forget, however, that this operation is associated with a premium and results in an increase in the principal on which future cash interest will be calculated. The toggle is therefore like fine wine: essential, but to be consumed in moderation.